Cyber Scam Recovery

Equaledge Broker Review

Equaledge has recently drawn attention from traders and regulators. This review provides a simple, clear, and factual breakdown of who Equaledge claims to be, the services it offers, its regulatory status, key warning signs, and what to do if you have already lost money.

About Equaledge

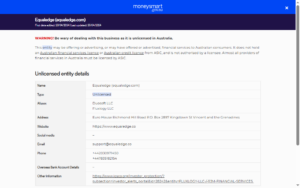

- Company Name: Equaledge

- Website: https://equaledge.co/

- Address: NA

- Regulation Status: Unregulated

- Blacklisted Status: It seems there is no direct mention of this domain being on a blacklist.

- Warned By: Australian Securities and Investments Commission (Australia)

Warnings By Australian Securities and Investments Commission

Equaledge

On the surface, Equaledge appears to be a reputable online brokerage firm where you can trade stocks, bonds, options, commodities, etc. Unfortunately, many investor testimonies indicate that Equaledge is a scam. The majority of investor accounts reveal that Equaledge has utilized fraudulent schemes similar to those other companies engage in.

They Utilized High-Pressure Sales Tactics

Once you open an account with a minimum deposit of approximately $250, you will be assigned a personal “advisor” (also known as a sales representative). The advisor’s role is to build rapport with the new client and introduce them to other as-yet-unrelated “clients” (which may include family members) over the phone through regular phone calls. During these phone calls, clients are encouraged to invest more money as quickly as possible.

Sudden Losses & No Communication

Issues tend to develop after investors stop adding or trying to retrieve their funds, and as such, communication ceases. Also, the funds in accounts have seemingly dropped in value with no explanation, sometimes reaching zero. The investors have requested fund withdrawals, but they have not received replies to these requests and have not received adequate information on transferring funds out of their accounts.

No Regulatory Oversight

The Equaledge site is unregulated by any reputable regulatory authority, which means it is not monitored, there is no protection for investors, and there is no process for resolving disputes formally. There is no evidence to show that Equaledge has conducted any type of trading activity based solely on the reports provided by investors of aggressive upselling, withdrawal failure, and lack of regulatory oversight. It is clear that Equaledge is likely to be an investment fraud operation. Therefore, you should exercise extreme caution.

Lost Funds to Equaledge?

If you have lost money to Equaledge, act quickly. Get help through a free consultation

Submit a case review request to explore fund-recovery options and get guidance on next steps.

Is Equaledge a Trustworthy Platform?

To understand if Equaledge can be trusted, check the following:

- Does Equaledge hold a valid license from top-tier regulators, such as the FCA, ASIC, CySEC, or other relevant authorities?

- Is the company registration information on the website real and verifiable?

- Are the listed phone numbers, office addresses, and legal documents traceable and legitimate?

- Do withdrawal complaints appear frequently in user reviews or forums?

- Are testimonials repetitive or overly positive, indicating possible fake reviews?

Conclusion

If proper licensing, transparency, or verified company details are missing, the risk level becomes significantly higher.

Always verify before depositing any funds.

How Risky Platforms Like Equaledge Usually Operate

1. “Pig-Butchering” / Long-Term Manipulation

Scammers build trust through messaging apps, social media, or dating platforms, eventually guiding victims to controlled trading websites where balances and profits are fake.

2. Clone Trading Platforms

These sites imitate real brokers. Charts, profits, and trades look authentic, but everything is controlled by scammers.

Withdrawals may be allowed initially, but later requests are blocked.

3. Other Common Tactics

- High-pressure calls urging you to deposit more money.

- Promises of high returns with no risk.

- Requests to pay “taxes,” “fees,” or “unlock charges” before withdrawals.

- A polished website with no real regulatory disclosures.

- Fake reviews, paid endorsements, or fabricated success stories.

Warning Signs Associated With Equaledge

- No valid or verifiable regulatory license.

- Untraceable company address or vague contact details.

- Aggressive sales strategies demand large deposits.

- Claims of “guaranteed” or “risk-free” profits.

- Multiple reviews reporting frozen accounts, blocked withdrawals, or unresponsive support.

What to Do If You Have Invested With Equaledge

Follow these steps immediately:

- Stop communication with Equaledge and any “account manager.”

- Contact your bank or payment provider to explore chargebacks, payment blocks, or recovery options.

- Gather all evidence such as emails, chats, payment receipts, screenshots, and transaction IDs.

- Report the case to your country’s cybercrime unit, police, or financial regulator.

- Seek professional recovery help if the amount lost is significant. Ensure the service is credible before hiring.

Quick Summary

Equaledge shows multiple high-risk indicators, including a lack of regulation, an unclear company background, and user complaints.

Before investing, verify its license, corporate details, and withdrawal track record. If you have already lost money, take swift action.

FAQ – Equaledge Broker

1. Is Equaledge a regulated broker?

Check the regulator’s database. If no valid license is listed, Equaledge is not regulated and may be unsafe.

2. Why can’t I withdraw my money from Equaledge?

Blocked withdrawals often indicate liquidity issues, fake account balances, or possible scam activity.

3. How can I confirm if Equaledge is legitimate?

Verify the license number, company registration, physical address, and regulatory disclosures. Lack of verifiable details is a red flag.

4. What should I do if Equaledge keeps asking for more deposits?

Stop sending money immediately. High-pressure deposit requests are a common scam tactic.

5. Can I recover lost funds from Equaledge?

Recovery is possible in some cases. Act fast by contacting your bank, collecting evidence, and seeking professional assistance.

Claim Your Lost Funds Back. Cyber Scam Recovery Services is the best companion in the path of your fund’s recovery

If you have been victimized by a Equaledge scam or any other fraudulent scheme, consider seeking assistance from reputable organizations like Cyber Scam Recovery, which specializes in fund recovery and has experience. Our free consultations can guide you through the process of recovering your funds, ultimately prioritizing your financial well-being. Stay vigilant and informed to protect your financial interests in an ever-evolving financial landscape.

Checkout the list of scam brokers 2025

Visit Twitter

Visit Tumblr

Visit Medium

Visit Linkedin