Cyber Scam Recovery

A Comprehensive EterWealth Limited Review: Is EterWealth Limited Fraud or Legit?

Cyber Scam Recovery Team has enough information to conclude that EterWealth Limited is a fraudulent broker. By writing this EterWealth Limited review, we aim to provide more details on EterWealth Limited brokers, revealing any red flags that could point to involvement in fraudulent activity. This EterWealth Limited review also provides insightful information on areas to be wary of, particularly when it comes to Forex scams, cryptocurrency scams, phishing scams, romance scams, Bitcoin scams, Gift card scams, and other possibly fraudulent activities.

EterWealth Limited Broker Website – https://eterwealth.com/

Website Availability – Yes

Location of Headquarters – 499/135 Phichai Songkram Road, Nai Mueang Sub-district,Mueang Phisanulok District, Phisanulok Province, Thailand

Blacklisted Status –

Domain Age –

Name-ETERWEALTH.COM

Registry Domain ID-2661963858_DOMAIN_COM-VRSN

Registered On-2021-12-16T04:50:45Z

Expires On-2025-12-16T04:50:45Z

Updated On-2023-12-16T19:00:17Z

Finding EterWealth Limited Broker Fraudulent Features

EterWealth Limited ventured into the online trading industry in 2021, providing forex, cryptocurrency, metal, and index services. Although it markets itself as a professional brokerage firm, several complaints from clients indicate otherwise. Complaints declare that the company practices dubious actions that endanger clients’ money.

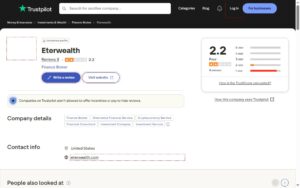

Trustpilot Low Ratings and Negative Reviews

Eterwealth-Reviews

Lack of Regulatory Oversight

EterWealth is purported to be registered in Saint Vincent and the Grenadines, a jurisdiction whose financial regulations are notoriously weak. This implies investors are not protected by well-established regulatory systems like the FCA (UK) or ASIC (Australia). Further, its purported authorization with the National Futures Association (NFA) in the U.S. is marked as unauthorized, which raises questions about inconsistencies in its claims.

Investor Complaints

Some of these traders complain that, whereas deposits are swiftly accepted, withdrawal orders are refused or denied without explanation. Clients also claim to be compelled to invest more money once their initial investment has been made, but are then unable to withdraw the money. Such behavior is a red flag in scam trading programs.

From investor accounts and regulatory inspections, EterWealth is revealed with several warning signs. Prospective traders should be cautious to the extreme and steer clear of this platform in order to protect their investments.

Evaluating Negative EterWealth Limited Reviews and Remarks

Examining negative EterWealth Limited reviews and comments from individuals who have dealt with them might provide useful insights into the broker’s legitimacy. Issues like as suspicious practices, withdrawal issues, or poor customer service require serious attention and investigation. These problems may highlight possible red flags, necessitating a more thorough assessment of EterWealth Limited operations and policies. Addressing such feedback with due diligence is essential for investors and consumers to make well-informed choices and protect their interests. Individuals may improve their assessment of EterWealth Limited credibility and trustworthiness as a service provider by paying attention to these warnings and properly researching any reported difficulties.

Scammed by EterWealth Limited? Get help through a free consultation

Defending Yourself Against Frauds, Such as EterWealth Limited

Preventing falling victim to scams like EterWealth Limited requires vigilance and a healthy dose of skepticism. To protect your financial well-being, take the following measures:

- Comprehensive Investigation: Before investing your capital in any opportunity or company, carry out in-depth research. Verify the legitimacy of their claims and scrutinize their operations for any red flags.

- Due Diligence: Steer clear of hasty choices and consult with reliable financial advisors before making investments. An extra layer of scrutiny can help you avoid falling into potential traps.

- Identifying Red Flags: Be cautious when presented with investments that promise unrealistically high returns, employ high-pressure sales tactics, or lack clear and transparent information about their services.

- Alerting Authorities: If you believe you’ve come across a scheme resembling EterWealth Limited, swiftly notify the appropriate agencies, like the FTC or SEC. Reporting such activities is not only in your best interest but also contributes to protecting others from falling into the same trap.

Victims of the EterWealth Limited scam can file a quick complaint here!

EterWealth Limited Review – Conclusion

In this EterWealth Limited review, we have explored potential red flags associated with the EterWealth Limited broker, discussed strategies to avoid becoming a victim of scams, and emphasized the paramount importance of transparency and regulatory information in the financial sector. While we refrain from making categorical claims, the significance of conducting thorough research, exercising prudence, and prioritizing financial security cannot be overstated.

Claim Your Lost Funds Back. Cyber Scam Recovery Services is the best companion in the path of your fund’s recovery

If you have been victimized by a EterWealth Limited scam or any other fraudulent scheme, consider seeking assistance from reputable organizations like Cyber Scam Recovery, which specializes in fund recovery and has experience. Our free consultations can guide you through the process of recovering your funds, ultimately prioritizing your financial well-being. Stay vigilant and informed to protect your financial interests in an ever-evolving financial landscape.

Checkout the list of scam broker 2025

Visit Twitter

Visit Tumblr

Visit Medium

Visit Linkedin